2026-02-19

Latvia’s AML/CFT system internationally recognised as overall effective

23.10.2019 Finanšu izlūkošanas dienests

The completed work of the Financial Intelligence Unit of Latvia (the FIU Latvia) so far and performance results show proof of changes that gradually enter the financial industry. Both the amount of frozen funds from potential money laundering, the amount of cases transferred to law enforcement institutions, and the results of the public-private partnership operation platform confirm the changes for now and in future.

Ilze Znotiņa, the Head of the FIU Latvia states, “Purposeful work of financial intelligence, successful cooperation between the partners of the public-private partnership, together with education of the notifying parties in the system about industry risks bring us hope that the reforms started in the financial system of Latvia, as well as the introduced changes are significant, and they will be irreversible – money laundering in our country is decreasing, and in future it will not be possible.”

The FIU Latvia performance results for the nine months this year have significantly increased; moreover, the progress has been observed in all areas.

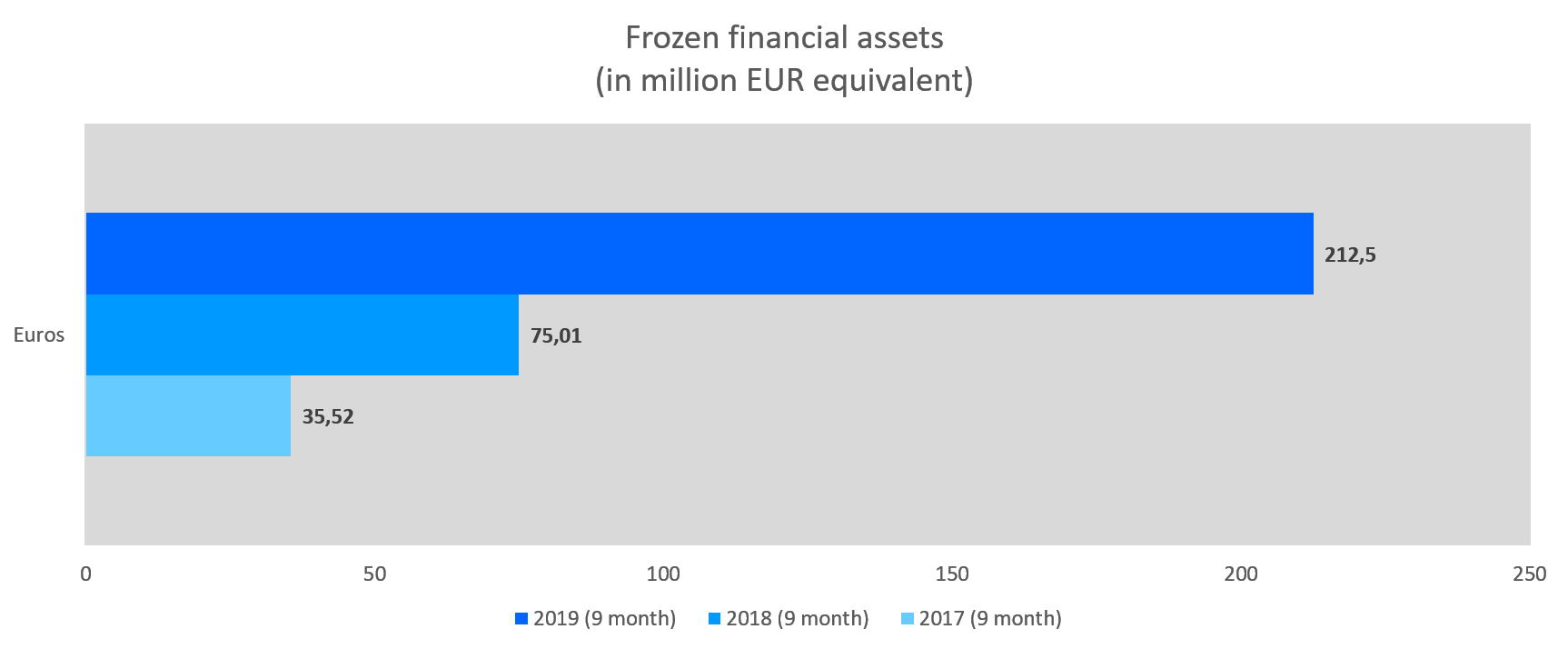

In nine months of 2019, the FIU Latvia has issued 266 freezing orders, whereafter potentially laundered funds of MEUR 212.5 have been frozen, which is by 183% more than last year 2018 when potentially laundered funds of MEUR 75 were frozen in nine months. During this time, also six immovable properties have been seized, and 24 orders have been issued to freeze financial instruments.

During the three quarters of this year, the FIU Latvia has received 3968 reports from subjects of the Law on the Prevention of Money Laundering and Terrorism and Proliferation Financing regarding suspicious transactions and 21,627 reports on unusual transactions. By comparison, during the nine months of 2018 the FIU Latvia received 5390 reports on suspicious transactions and 17,458 reports on unusual transactions.

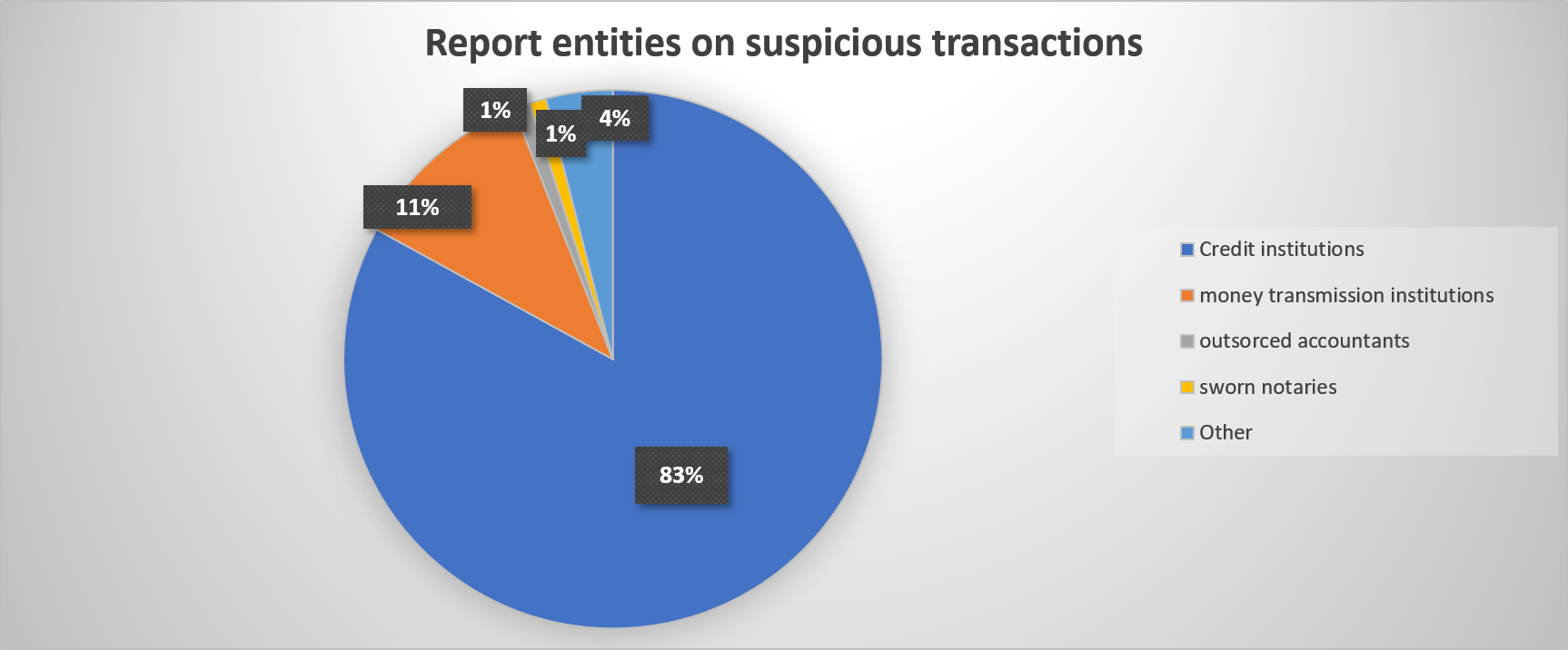

During the nine months of 2019, the FIU has received 10 reports regarding potential terrorism financing and one report regarding a potential proliferation financing. Financial institutions are the most active notifying parties that report on suspicious transactions to the Financial Intelligence Unit of Latvia.

During the nine months of 2019, the FIU has sent 153 materials to law enforcement institutions for further investigation, which is by 12% more than in the nine months of 2018. In 88 cases, the responsible institutions have initiated criminal proceedings, whereof 55% are criminal procedures regarding autonomous money laundering offences.

During the nine months this year, the most popular predicate criminal offences in Latvia, whereafter the obtained funds were later legalised, are criminal offences with regard to taxes and economy, fraud and bribery (malfeasance).

During the first half of 2019, 33 criminal proceedings were initiated with regard to evasion from cash declaration (transporting across the border of Latvia). Under statutory requirements, at the border (both upon entry and exit from Latvia) each person needs to declare cash exceeding EUR 10,000 by indicating its origin.

The public-private partnership on anti-money laundering matters continues with success. This platform was established to create a uniform understanding regarding approach to the monitoring issues, to improve mutual cooperation, awareness and ensure feedback. In 2019, 57 meetings were held, and the amount of frozen funds in matters that were discussed at the public-private partnership meetings has exceeded MEUR 113. The cooperation platform between the monitoring and control institutions has been operating since November 2018.

To improve the information flow, the FIU Latvia, in close cooperation with monitoring and control institutions organises seminars to the subjects of the Law on the Prevention of Money Laundering and Terrorism and Proliferation Financing. During the seminars, the FIU Latvia informs about the risk assessments carried out during 2019 in the areas of anti-money laundering, terrorism and proliferation financing, about the risks in each industry, as well as their significance in introduction of the internal control system, as purposeful cooperation between the FIU Latvia and law subjects ensures immense results.

In financial intelligence, equally important is the international cooperation and information exchange with the analogous foreign institutions. During the first nine months of 2019, the FIU has received 516 requests from foreign FIUs and has sent 627 requests to foreign financial intelligence units. The main cooperation countries are Lithuania, Estonia, Germany, Poland, UK, Czech Republic, Russia, Moldova, Ukraine and Belarus.

2026-02-19

Latvia’s AML/CFT system internationally recognised as overall effective

2026-02-16

VDD requests criminal prosecution for violation of EU sanctions