2026-02-19

Latvia’s AML/CFT system internationally recognised as overall effective

30.12.2025

As sanctions continue to reshape Russia’s economic landscape, understanding their true effects has never been more important. In this article, Paulis Iļjenkovs, Deputy Head of the Financial Intelligence Unit of Latvia (FIU Latvia) for Sanctions, and Benjamin Hilgenstock, Head of Macroeconomic Research and Strategy at the Kyiv School of Economics’ KSE Institute, examine how sanctions are influencing Russia’s economy, evaluate their effectiveness, and discuss what still needs to change.

Since Russia’s full-scale invasion of Ukraine in February 2022, the European Union (EU) has introduced 19 sanctions packages against Russia – building on measures that began after the illegal annexation of Crimea in 2014.

“Because sanctions must be unanimously renewed every six months, political pushback can significantly weaken their impact,” notes Mr. Hilgenstock.

This, he argues, explains why some Member States still import Russian energy more than three and a half years into the full-scale war. Yet despite these constraints, the EU has made notable progress – the unexpected agreement to ban Russian LNG transshipments in Europe shows that further steps remain possible.

Mr. Iļjenkovs highlights additional challenges faced by businesses, financial institutions and Member States. While sanction decisions are made centrally, each Member State is responsible for their actual implementation. This has resulted in decentralisation and fragmentation of sanctions implementation. For example, many countries have not introduced criminal liability for violations of sanctions in line with the EU Directive. Implementation gaps can also appear within a single country. To mitigate this risk, Latvia has designated the Financial Intelligence Unit as the central authority responsible for coordinating and overseeing sanction implementation.

Paulis Iļjenkovs, Deputy Head of the Financial Intelligence Unit of Latvia (FIU Latvia) for Sanctions

Both experts note that sanctions implementation is improving, but further effort is needed.

“Making sanctions truly effective requires deliberate and sustained investment,” Mr. Iļjenkovs emphasises.

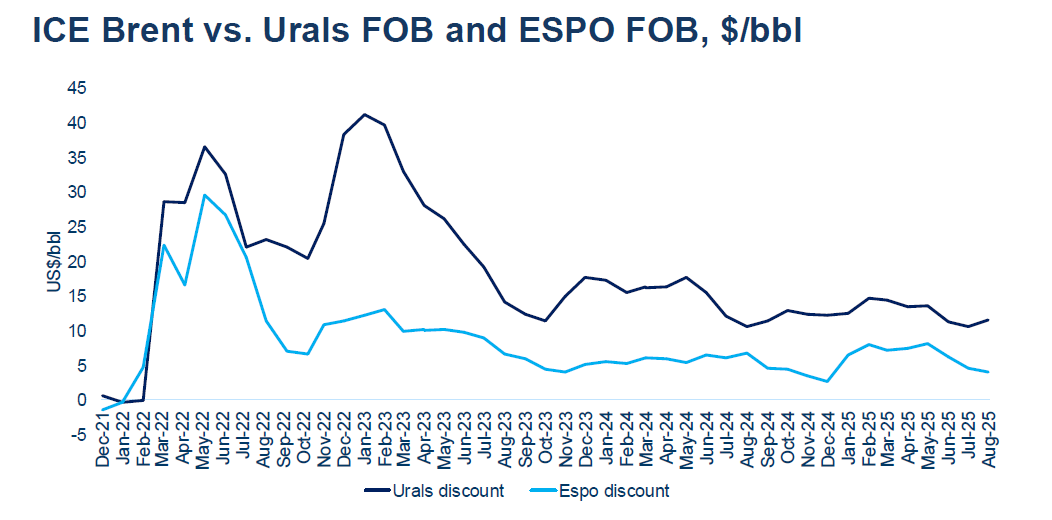

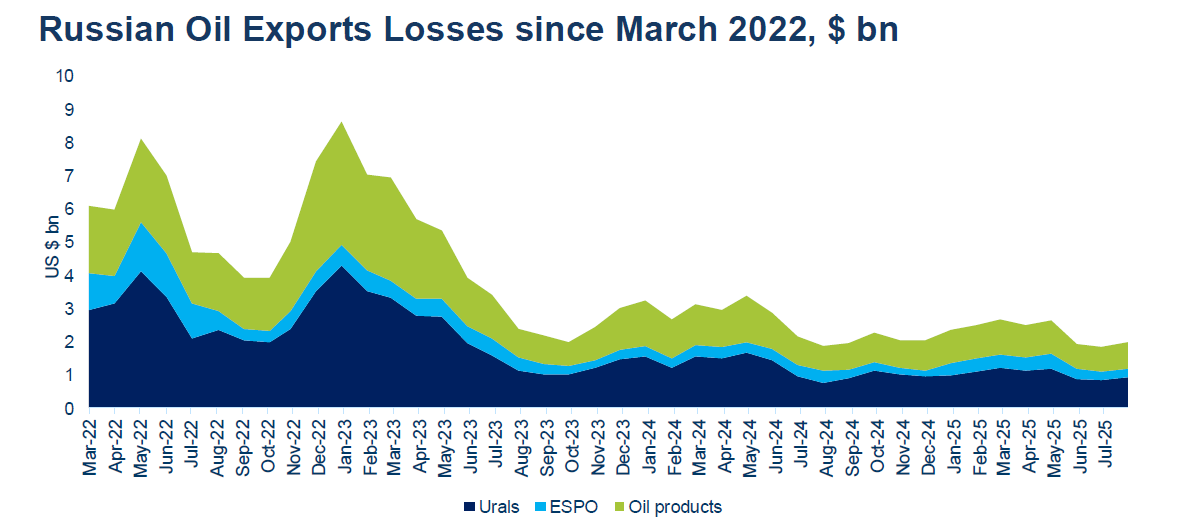

When asked which sanctions has most impact on Russia, both experts agree that energy measures have inflicted the greatest damage. The EU’s embargo on crude oil and petroleum products significantly restricted Russia’s access to the European market. This forced Russia, in early 2023, to seek new buyers elsewhere, often selling oil at large discounts, which ultimately led to a substantial reduction in revenue. The KSE Institute estimates that, from March 2022 until August 2025, Russia have lost USD 159 billion in potential earnings (see Figure 1.,2.).

Mr. Hilgenstock cautions that the rise of the shadow fleet and the weakening effectiveness of the oil price cap have reduced the overall impact – yet energy sanctions remain the most damaging tools available.

Figure 2. Estimated Russian oil export losses. Source: IEA Oil Market Reports; KSE Institute estimates.

Next in importance, according to both experts are export controls on dual-use goods and other high-priority items. Although technology of European origin still finds its way into Russian military equipment and evidence shows that sanctions have not fully halted the acquisition of Western-made components through complex supply chains – such procurement often involves significant cost premiums compared to normal market conditions. Mr. Hilgenstock notes that this may be due either to the number of intermediaries involved in circumvention schemes or to Chinese suppliers overcharging, knowing how dependent Russia is on these technologies.

Financial sanctions are equally significant. Mr. Iļjenkovs also underscores the impact of measures targeting Russian oligarchs, whose influence shapes Kremlin decision-making. Mr. Hilgenstock highlights the freeze on Russian Central Bank assets within the EU, noting that the loss of access to foreign reserves limits policy options, contributes to high interest rates, and further destabilises the ruble.

In October 2025, the Office of Foreign Assets Control (OFAC) imposed new sanctions on Rosneft and Lukoil – the two largest Russian oil companies. The initial impact will be substantial, Mr. Hilgenstock argues, as OFAC is clearly signalling a secondary-sanctions threat to foreign banks. To keep export volumes up, Russia will have to offer further discounts on its already heavily discounted oil.

How long this period will last remains uncertain, as both experts agree that the effectiveness of these sanctions will depend on how strictly OFAC enforces them. Some exemptions have already been granted, which lessens their effect. There is also the possibility that Russia could establish shell companies to purchase sanctioned oil and then resell it downstream, removing the names of Rosneft and Lukoil from the transaction and thereby enabling banks to process payments. Whether OFAC will take a tough stance on such potential evasion schemes remains to be seen.

Mr. Iļjenkovs notes that Lukoil’s major presence in Europe’s retail fuel market makes it particularly exposed. At the same time, the impact on Latvia is expected to be minimal, as Rosneft has effectively been treated as sanctioned since its CEO, Igor Sechin, was listed in 2022, while Lukoil’s business presence in Latvia remains small.

After more than three and a half years, Russia’s invasion of Ukraine continues, raising questions about what its duration reveals about the state of Russia’s economy.

Mr. Hilgenstock notes that waging a prolonged war outside one's own borders is extremely costly, although an authoritarian regime can sustain such aggression for a considerable period. At the same time, Russia is not undefeatable: it failed in its military objective to capture Kyiv within three days, and its advances have been slow and achieved at a high cost.

“The length of the war shows that the pressure applied so far has not been sufficient – and needs to be intensified,” he concludes.

Sanctions have meaningfully weakened Russia’s economy and warfighting capacity, but their long-term effectiveness depends on continued coordination, implementation and political resolve. Maintaining and strengthening this pressure is essential if the international community is to support Ukraine effectively and limit Russia’s ability to sustain its aggression.

The conversation between experts, held during the FIU Latvia-organised conference “Guarding the Gate: Sanctions, Export Controls & Business Responsibilities.” The conference served as an important platform for dialogue among experts, policymakers, and business representatives, strengthening a shared understanding of the role and effectiveness of sanctions implementation.

Conference recording in English:

Conference recording in Latvian:

The FIU Latvia website provides access to sanctions lists and other useful information.

Since April 2024, FIU Latvia has been the national competent authority for sanctions implementation in Latvia.

2026-02-19

Latvia’s AML/CFT system internationally recognised as overall effective

2026-02-16

VDD requests criminal prosecution for violation of EU sanctions